When we think of 5G, we often think about the benefits for the consumer ie. faster download and upload speed, and higher video streaming quality. However, 5G has a major role in bolstering existing industries that rely on connection. These wireless networks have the potential to transform industries; from automotive to healthcare, or even finance, 5G will have the capability to improve and strengthen existing services, whilst also creating new ones.

As such, Distrelec has analysed the industries where 5G will have the greatest impact, by assessing the wider landscape for ‘enabler’ companies, as well as industry-specific ones. This aims to give a comprehensive overview of the companies that are currently utilising 5G connectivity, as well as the ones that may rely more heavily on the network in the near future.

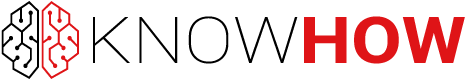

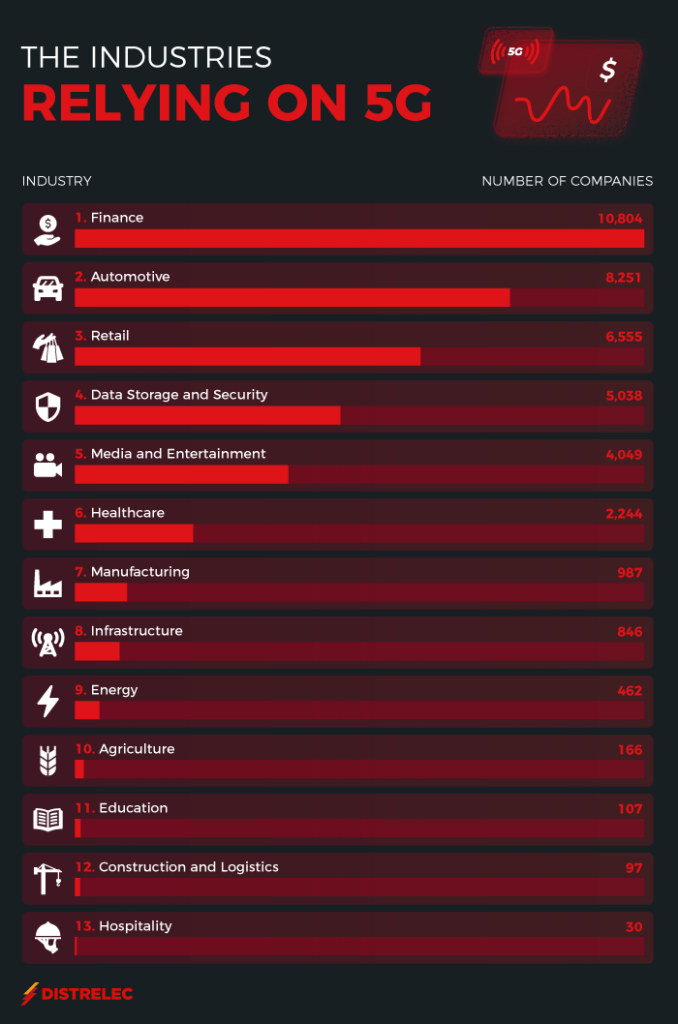

The industry with the highest amount of companies currently relying on 5G technologies is the finance sector. With 10,804 companies ranging from consumer-focused services such as online banking to more business-related ones like capital investment, there’s undoubtedly a reliance on current wireless networks, as well as potential growth with the wider 5G rollout. The vast majority of these companies fell under the cryptocurrency use case (9,223), with 5G technology allowing users to purchase the token 100 times faster and with greater clarity.

Placing second in our study was the automotive industry, with 8251 companies. The vast majority of these (5,324) fell within the manufacturing sector, with 5G-enabled technologies better allowing brands to make use of automation, and push out servicing software via over-the-air (OTR) updates. However, the future of 5G within the automotive sphere also stretches to autonomous vehicles, which occupies another sizeable chunk (2,923) of the 8,251 companies employing 5G. Ultimately, without the speed at which data can be collected and transmitted via 5G, self-driving vehicles could not come to fruition, showing that the sector may increasingly rely upon this technology in the coming years.

The retail industry came in third position, with 6,555 companies relying on 5G development according to our study. The vast majority of these were in the digital signage sphere (6,489), with 65 being related to interactive kiosks. Digital signage essentially allows businesses to better connect with consumers in-store to display ads, videos, and other messaging that can be targeted toward consumers. According to Shopify, 68% of customers say digital signage would make them more likely to buy advertised products, and as we move ever closer to customers doing the bulk of their shopping online, digital signage could be an essential means of blending the two experiences and encouraging customers to shop more in-store, potentially highlighting an opportunity for growth.

Aside from the aforementioned use cases falling within the finance, retail, and automotive spheres respectively, there are several other usages that have the potential to grow. Some of these are video streaming, data storage, data security, and telehealth.

Our study found that the video streaming sector also depends on improving technology offerings to provide a better experience to customers. Crunchbase highlighted 3,982 companies, and with the growing consumer demand for streaming without buffering, ‘media and entertainment’ could be an industry to watch. Netflix has roughly 220 million subscribers, while YouTube has 2 billion monthly active users, and according to a 2020 Nielson report, 77% of users said that streaming and playback quality was one of the most important streaming service attributes, emphasising the importance of this in the ongoing ‘streaming wars’.

Data storage (3,041 companies) and data security (1,997 companies) also ranked highly when it comes to the most popular use cases. These sectors interrelate, with 5G enabling higher volumes of data storage with more accessible consumption of high-resolution content, in turn, these higher volumes of data also need to be met with advanced security.

Another use case that is projected to see substantial growth, is telehealth. At present, there are 1,428 companies within this sphere relying on 5G technology, with this set to grow as the industry advances. 5G is instrumental in delivering telehealth proficiently, as it closes the data reliability gap by improving speed, latency, and connectivity. It also provides a better experience for users due to the reduction in buffering during video conferencing. This connected care model will foster more of a predictive healthcare model, working in collaboration with wearable technology, rather than one that focuses on solving concerns once they’re already underway.

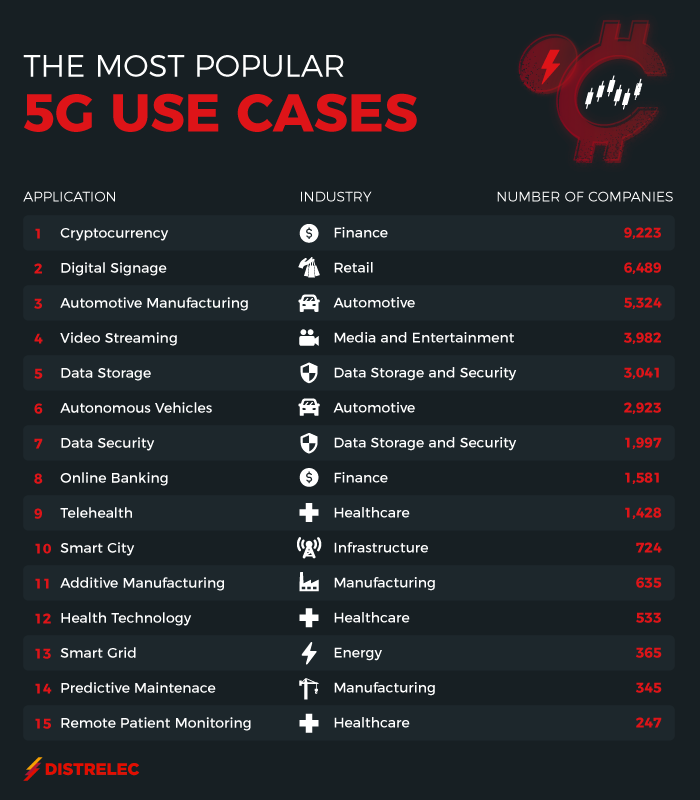

We then wanted to analyse more generic companies, without specifying the industry, taking note of the top 100 to discover their location and how they will impact industries relying on 5G as a whole. We found that the vast majority of these companies were based in North America (60%), and Asia (21%).

According to GSMA Intelligence, adoption of 5G is booming in North America and will dominate the wireless services sector by 2025, Telco wireless network investments during the next five years are also expected to almost exclusively focus on 5G. This infrastructure allows for the necessary connectivity to facilitate 5G-empowered businesses. By 2025, the US is predicted to have the second-highest 5G adoption rate in the world, surpassed only by South Korea, while Canada is expected to rank in fourth position, behind Japan in third.

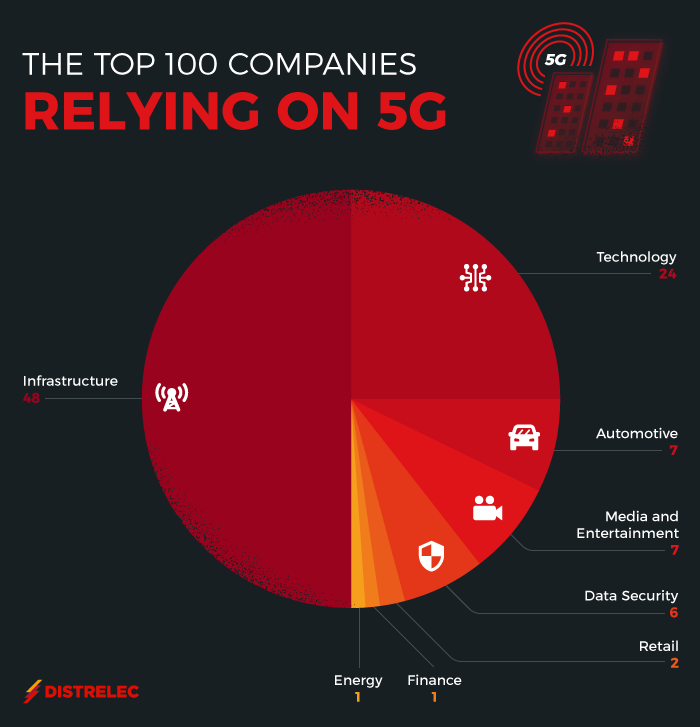

When it comes to the nature of these companies, they primarily fall within the infrastructure (48%), and technology (24%) spheres, which can also be seen as ‘enabling’ enterprises. These companies operate across industries, focusing on developing the groundwork upon which the industry-specific 5G use cases are built.

Intel appeared as the first entry within our search, with their expanded product offerings that provide end-to-end solutions, scaling from edge computing to 5G network, and emerging fields of AI, operating across industries to give rise to new 5G-enabled companies within more specific domains.

Cohere Technologies appeared second, as the innovator of software that improves user experience with channel detection, estimation, prediction, and precoding deployed within a standard-compliant 4G, 5G, or Open Cloud RAN.

Our study found that while industry-specific innovations are important and definitely set to grow, we also cannot overlook the infrastructure and technology-based businesses that improve the field in which industry-specific companies operate, by investing in 5G solutions to aid functionality.

——————————————————————————————————————————-

Methodology

We used Crunchbase to explore companies within some of the top industries predicted to be affected by 5G technology, filtering by sector, and then searching with reference to the keywords ‘5G’ and ‘IoT’.

We also examined the first 100 results within the platform in reference to the keywords without filtering by industry sector to gain a clearer picture of the advancing landscape.