The car industry is undergoing its most significant transformation since Tom Ford’s first production line in 1913. Now, the progression focuses mostly on electric vehicles (EVs) that have the potential to revolutionise the automotive industry.

What once used to be a distant vision and futuristic transportation technology has finally become a reality. The journey towards a low-carbon future is becoming a global mission, with countries around the world recognising the urgent need to shift to more sustainable modes of transportation. It is possible to notice a growth in e-mobility across plenty of nations. However, no country is fully ready to embrace the EV transition yet, but some are close.

This article explores the forefront of EV adoption in several important markets and looks at the front-runners in the competition for a sustainable future. It seeks to understand how these countries are investing in the development of new EV models and expanding public access to electric vehicles. It will evaluate these nations’ general readiness for a full EV transition, paying special attention to developments in energy and charging infrastructure.

Global EV Market Growth

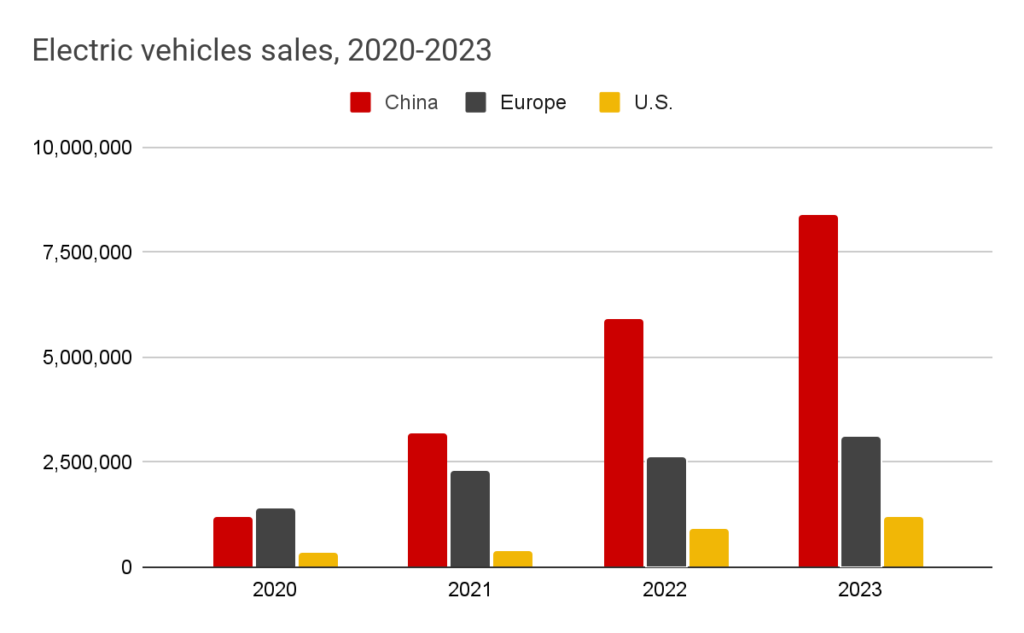

Electric vehicles are growing in popularity, with many global markets showing a significant rise. According to Canalys, with 7.6 million units shipped and a 55.5% market share, Greater China (Mainland China, Hong Kong, Taiwan and Macau) continues to be the largest EV market. North America and Europe make up the top three markets, with 1.8 million and 3.2 million units.

With China, Norway and several of the European Union countries leading the EV market, each setting a new benchmark in EV adoption, the race to electrify the world’s roads is on. And as Canalys predicts, by 2024, 17.5 million EVs will be sold worldwide, a 27.1% growth rate.

The Largest EV Markets

- China

- Europe

- United States

China

China is the world’s largest EV market, and the Asian country recently raised its goals for EV penetration, going from an initial target of 40% by 2030 to a target of 45% by 2027. According to Statista, from 2024 to 2028, the Chinese electric vehicles market is expected to grow at a consistent 5.69% annual rate, with a projected market volume of US$398.0 billion at the end of that time.

China provides relatively low-cost electric vehicles from manufacturers such as BYD, SAIC, BAIC and Geely. Additionally, it is the world’s biggest producer and exporter of batteries and battery components, and Chinese companies like CATL have experienced remarkable growth in recent years. The main technologies they are using are technological patents and wireless charging.

Chinese automakers are also planning to introduce fast EV charging options for their vehicles and raise the number of charging stations. Huawei Technologies intends to build 100,000 fast EV charging stations throughout China, including ones that are more than twice as quick as Tesla’s.

Europe

Europe has the second biggest demand for electric vehicles after China and is anticipated to increase its battery production capacity significantly in the coming years. Between 2010 and 2020, 25% of worldwide electric vehicles were produced in this region. In 2020, the European electric vehicle market grew at an unprecedented rate. As stated in the ‘Update on electric vehicle uptake in European cities’, in the European community, more than 1.36 million new electric passenger cars, including battery-electric (BEV) and plug-in hybrid electric vehicles (PHEV), were sold, up 143% over the previous year.

If we define EVs as battery-electric vehicles and plug-in hybrids, Europe overtook China as the world’s largest EV market in terms of EV sales in 2020. But when it comes to worldwide EV sales and deployment, China is obviously the leader—this East Asian country is home to over half of the world’s electric vehicles, and the US and Europe are rather struggling to keep up.

The increase in sales coincides with many European countries establishing dates to phase out fossil-fuel vehicles, as well as the European Commission proposing an effective ban on new CO₂-emitting cars beginning in 2035 to achieve carbon-neutral transport by 2050. Europe has also imposed carbon emission standards and electric vehicle subsidies for carmakers and consumers. With laws regarding priority lanes and parking, as well as the implementation of awareness campaigns, cities are well-positioned to act on convenience and awareness.

The United States

The US is one of the third-largest markets for EVs, but its sales are only a fraction of those made in Europe and China. The US is attempting to catch up, but it is far behind China and Europe. Although the American EVs market saw a notable growth of 5.9%, with sales reaching 1.2 million units in 2022, EVs still represented only a 7.6% share of the total vehicle market in the United States by 2023.

According to RystadEnergy, even though the US electric vehicles market is growing and is predicted to reach 2.46 million units by 2028, due to consumer decisions to convert to electric vehicles being complicated by uncertainty around tax subsidies and borrowing rates, the US EV sector is struggling to keep up (see Figure 1 above).

To improve the situation, as per the New York Times, President Biden proposed some ‘aggressive rules’ to transition to electric vehicles fleet faster. Under President Biden’s Bipartisan Infrastructure Plan, the country is going to invest US$7.5 billion in EV charging as well as EV battery components. On top of that, the US wants to achieve net-zero emissions by 2050 and plans to do so by investing in creating more roles for specialists in the manufacturing and installation of EVs, US$10 billion in clean transportation, and more than US$7 billion in essential minerals and materials.

List of European Countries Leading the EV Race

EV readiness varies globally, with some countries advancing faster. This ranking highlights nations that are taking some steps towards the electric transition, including the number of electric car sales, strategic approaches and future plans. If you are wondering which country is leading the EV market in Europe, have a look at the following list.

- Norway

- Iceland

- Sweden

- Finland

- Netherlands

- Denmark

- Germany

- United Kingdom

- Switzerland

- Luxembourg

- Austria

- France

- Belgium

- Portugal

- Italy

- Hungary

- Spain

- Greece

- Poland

- Romania

- Slovakia

- Czech Republic

Norway

Norway’s approach has been known as the role model in Europe, with more new electric cars being sold there than fuel. EV sales skyrocketed in 2023, representing 82.4% of all new car sales , up from 79.3% in the previous year, as reported by the Norwegian Road Federation. This trend showcases Norway’s leadership in transitioning to electric transportation.

Since the 1990s, the Norwegian government has put new policies in place to start investing in electric cars. Norway’s impressive performance in the electric vehicle market is mostly due to a comprehensive set of incentives set to promote zero-emissions vehicles. Because of these substantial advantages—such as free parking, no tolls, and lower taxes—electric cars are becoming a more appealing choice for buyers. Nevertheless, Norway is expanding its sustainable mobility as not only automobiles have gone electric there, but there is also a network of buses, trains, and trams, as well as a large number of electric bicycles.

According to the Norwegian Electric Vehicle Association, the Norwegian Parliament has established a national objective requiring all newly marketed automobiles to have zero emissions by 2025 (either electric or hydrogen). The Norwegian Parliament came to an agreement that permits counties and municipalities to ‘charge no more than 70% of the price for fossil fuel vehicles on toll roads’.

Sweden, Iceland, Finland

Nordic countries are featured in the top five as they adapt quickly to automotive electrification. In 2021, there were about 5 million registered cars in Sweden, a country with 10.5 million people. Sweden’s economy is heavily dependent on the automobile sector, which is also the country’s largest import and export market. Sweden also wants to become the first country to build a permanent, electrified road for EVs. And like Norway and Sweden, other Scandinavian countries reduce annual road taxes and offer free parking or support private parking schemes. They also raise awareness through public education about the importance of road electrification and overall support.

Netherlands

The Netherlands is one of Europe’s and the world’s leading electric vehicle markets. The government of the Netherlands has set a goal to ensure that all new automobiles that are driven on public roads by 2030 are emission-free. The country has been at the forefront of encouraging the usage of electric vehicles.

Nearly half of all new cars in the Netherlands were electric in 2023, so there is a growth and relatively high rate of EV uptake in that country. However, the prices for petrol or diesel are also high compared to other European markets. According to data from 2021, the Netherlands had the second-highest number of electric chargers in the world after China. As of September 2023, there were 142,297 regular charging locations but only 5,043 fast-charging locations overall. This means that more than half of the charging locations take more than 6 hours to charge a vehicle fully, so the country needs to focus on fast-charging infrastructure to improve the EV adoption rate.

Denmark

Although Denmark shied away from electric automobiles for years because of growth-stifling regulations and prohibitively expensive costs, with a neighbour like Norway, it had to change its approach. The government only realised a few years ago that if Denmark is to meet its aggressive climate targets, they have to invest in greener transportation. Therefore, BEV and PHEV sales in Denmark have risen significantly in recent years and in less than a year, the number of electric vehicles sold in Denmark has nearly doubled. The country also plans to have 1 million green cars by 2030.

Therefore, the amount of diesel cars is reduced as Danes decide on more environmentally friendly choices. To do so, Denmark put in place a new taxation to increase the number of green cars on Danish roads. As per European Parliament, the Climate Act, which was adopted by the Danish Parliament in June 2020, has legally-mandatory goals of achieving climate neutrality by 2050 and a 70% decrease in GHG emissions by 2030. Every five years, the government is also required to set sub-targets.

Germany

Germany is a well-known leader in the automotive industry and is home to many major car manufacturers, including BMW, Mercedes-Benz, and Audi. In terms of recently registered fully electric vehicles, Germany was a leader in 2022. As per ACEA data, Germany topped the European chart in 2022 with more than 350,000 new completely electric car registrations. However, according to recent sources, Germany will see a drop in EV sales, as already this year, it was possible to notice a 9% decrease in January 2024 compared to January 2022.

In regards to the 2030 Climate Action Programme and their battery technology advancements, the German government plans to create a master plan for the infrastructure supporting charging stations and encourage the construction of a network of public charging stations by 2025 with a million charging stations in use by 2030. The provision of charging stations on customer parking areas will become mandatory for all German petrol stations.

Currently, Germany has around one million electric cars on the road but they plan to reach a target of 15 million by 2030. To do so the nation needs to sell 14 million in the next six years. The most popular models in Germany were Tesla Model Y and Skoda Enyaq.

United Kingdom

Although the UK ranked as the fifth top market for EV readiness in the EY report in 2023, according to the most recent British media, there are concerns that the UK could lag behind in the battle to electrify vehicles. For instance, the country has postponed until 2035 (previously 2030) its plan to outlaw the sale of new petrol and diesel vehicles. According to the British government, it means that by 2030, 80% of new cars and 70% of new vans sold in the United Kingdom are expected to be emission-free with that number rising to 100% by 2035.

Nevertheless, the overall UK EV market is fairly strong. The latest data from the Society of Motor Manufacturers and Traders (SMMT) shows that the new car market expanded by 8.2% in January 2024, the same month that Britain’s millionth battery electric car hit the road. Also, the number of chargers in the UK is growing rapidly, and there are currently around 170 ultra-rapid charging hubs in the country.

However, to meet the climate targets by 2050, all vehicles—including heavy-goods vehicles (HGVs)—must be fossil fuel-free in order to achieve net-zero, according to the British Climate Change Committee. This will involve replacing 55% of all vehicles with electric vehicles, increasing the number from around 400k to 23.2 million by 2032, and potentially up to 49 million (100%) by 2050.

Switzerland

In 2021, the Swiss market grew almost to the Norway and Netherlands electric car market size. Switzerland, which has a gross domestic product (GDP) similar to Norway’s, established its own EV volumes. Even though electric vehicle sales slowed down in Switzerland, one in five new cars (20.9%) was an electric vehicle in 2023. It is not a bad share, but the lack of charging infrastructure and the lack of government incentives slow down the growth of e-mobility.

As per Swissinfo, out of 4.5 million cars overall, 163,511 electric vehicles were on Swiss roads as of January 1, 2024, so it will likely take another 20 years for the full fleet to go electric, according to the Swiss eMobility estimations. In terms of Swiss future plans, the Alpine country wants to become carbon neutral by 2050. Currently, the best-selling electric car in Switzerland is the Tesla Model Y, which is the same model as in Europe.

Luxembourg

Luxembourg is on a good path towards the electric transition. However, despite a 72% increase in new registrations from 2022 to 2023, the percentage of fully electric vehicles in Luxembourg’s fleet as of December 2023 is still only 15.7%. The charging infrastructure situation in Luxembourg is comparable to that of other EU reference countries. Furthermore, in the summer of 2022, Luxembourg installed stations known as “SuperChargy” on its major thoroughfares, which are far more powerful—between 160 and 300 kW. With these recent installations, it is possible to charge a battery from 20% to 80% capacity in 15 to 45 minutes.

Austria

Approximately 30% of Austria’s CO2 emissions come from transportation. Hence, Austria has implemented stringent laws, such as a ban on combustion-engine vehicles until 2030, in an effort to advance e-mobility. The goal of this action, which is a component of Austria’s “Mobility Master Plan 2030,” is to register solely zero-emission cars starting in 2030. The plan aims to direct Austria’s mobility transition. However, as Gewessler, Federal Minister of Infrastructure in Austria, mentioned, it is not binding but rather more a ‘map and compass’ for mobility change.

In order to facilitate the transition to electric vehicles, Austria had 3,338 fast charging stations and 1,109 ultra-fast recharging points and 17,927 regular charging stations as of March 4, 2023. Fast-charging infrastructure is also expected to be expanded along roads and at park-and-ride locations. Austria wants to be carbon neutral by 2040; thus, by 2030, all new cars in specific categories must be emission-free; new buses must be by 2032, and commercial vehicles weighing more than 18 tonnes must be by 2035.

France

French incentives for the purchase of a new fully-electric or plug-in hybrid vehicle, as well as trade-in bonuses for cleaner new and used cars were extended, and batteries and plug-in hybrids accounted for 26% of newly sold automobiles in France in 2023, a significant 47% increase over 2022.

In terms of the combustion ban, France plans to start banning drivers from using petrol or diesel cars from 2035, like other European countries. Additionally, France introduced new green eligibility guidelines in September, marking a first for environmental policy when it comes to giving subsidies for electric vehicles. The government’s €5,000–€7,000 incentive will only be given to electric vehicles with a carbon footprint of less than 14.75 tonnes of CO2 starting in 2024.

Belgium

Belgium has made significant progress in the electricity and natural gas markets. It has decreased its reliance on fossil fuels while increasing its usage of renewable energy. In addition, the economy of the country is becoming less energy demanding. The government provides a tax incentive to establish charging infrastructure in Belgium in order to achieve the goal of a green fleet. The purchase of a home charging station will result in a tax reduction on the citizen’s personal income tax return.

The Belgian Parliament has approved a law proposed by Finance Minister Vincent Van Peteghem to speed up the country’s electrification of business automobiles, and starting in 2026, tax deductions will only be granted for expenses associated with zero-emission vehicles.

Portugal

To encourage EV ownership and make it more appealing to consumers, Portugal has created a variety of tax advantages and grants. In order to make EV ownership more viable, it is also investing in EV charging infrastructure.

According to data from the Portuguese Automobile Association (ACAP), there were 2,258 new passenger electric automobile registrations in January 2023, up 134.7% over the same month in 2022. Hence, sales of electric vehicles in Portugal increased by 101.9% in 2023 over 2022, as per the Portugal News, with Tesla being the most popular choice.

Italy

Italian EV sales have significantly grown in the last few years, with 115,000 electric car units sold in 2023—a 70% rise from 2022. However, ranking 15th place in September 2022 for its amount of charging units, Italy is lagging behind other European countries.

The plan is to add more than 21,000 outlets in urban areas and long-distance driving to the charging network nationwide by 2025. The Italian National Resilience and Recovery Plan, (NRRP) will provide €713 million, or over US$800 million, in funding for this project. In terms of national targets, the government in Italy is planning to cut the net vehicle emissions to zero by 2050 and replace pollution models by 2035.

Hungary

The Hungarian government programme is hastening the adoption of green automobiles, placing Hungary in quite a good place in the European EV transition, with the potential to even become a leader in Europe’s shift, along with Poland. According to Hungary Today, out of the almost 4.1 million passenger cars in Hungary, sales data also reveal that 32,000 electric and PHEV passenger cars and light commercial vehicles were on the road. To put it another way, the percentage of electric vehicles was 0.78%, as opposed to 0.21% and 0.17% in Slovakia and the Czech Republic, respectively.

With an investment from China of potentially €20 billion or $21.5 billion for EV-related investment, BYD, one of China’s top EV producers, intends to establish its first electric vehicle manufacturing plant in Hungary.

Spain

Spain is one of the largest passenger car markets in Europe, but the percentage of electric cars is still quite low there even though in comparison to the same period in 2022, sales of electric vehicles have nearly doubled in the first four months of 2023. Nevertheless, Spain’s market share for electric vehicles remains at 10%. Spain failed to register one million passenger cars before the deadline in 2023. With 81,772 units sold in December, an increase of 10.6%, it fell short of expectations. 949,359 electric cars were driven on Spanish roads at the end of the year, representing a 16.7% increase.

In terms of EV charging infrastructure, there were 25,106 public charging stations in Spain at the end of the first half of 2023 (a 16.4% growth over the previous year). To accomplish the goal of more than 100,000 stations by 2025, they need to quadruple the number of charging stations.

Greece

Greece is in its early adoption of street electrification. A country of approximately 10 million people, Greece has only emerged from a horrific decade-long debt crisis and still relies largely on fossil fuels for electricity. However, Greek plans put in place in 2020 are aspiring: carbon-neutral agriculture, solar fields, sustainable tourism, and entrepreneurial start-up campuses could theoretically modernise Greece, creating up to 200,000 new jobs in the energy and environmental sectors.

According to Ekathimerini-com, a Greece news website, Greece had 4,890 charging points spread among 2,120 e-vehicle charging stations at the end of 2023. Giorgos Ageridis, president of the Hellenic Institute of Electric Vehicles (ELINHO), added at the “Energy Storage & Charging Infrastructures for E-mobility,” event that by 2025, there will be 13,000 more charging stations, and by 2030, there will be over 100,000.

Poland

Poland is taking small steps towards the electric vehicle transition, but progress is starting to be visible. 45,214 all-electric and BEVs were registered in Poland as of the end of June 2023, according to the E-mobility Index, which was released by PZPM (Polski Związek Przemysłu Motoryzacyjnego) and PSPA (Polskie Stowarzyszenie Paliw Alternatywnych). Its number climbed by 11,489 units in the first half of this year, 72% more than in the same period of 2022. Although the number is increasing more quickly, it is still far less than the government’s goals, which called for one million electric cars to be on Polish roads by 2025.

In the European Union, Poland has one of the lowest percentages of electric automobiles. European Climate Foundation believes that investments in battery manufacturing facilities, such as LG Energy Solutions’ extensive lithium-ion manufacturing plant in Wroclaw (the largest lithium-power battery plant in Europe), could put Poland’s economy in a good position from the shift to electric powertrains and domestic firms like Solaris are establishing themselves as among Europe’s leading developers of low-carbon vehicles.

Romania, Slovakia, Czech Republic

Poland, Hungary, Slovakia, the Czech Republic, and Romania are the main markets for electric cars in Eastern Europe. The countries with the slowest rate of EV adoption include the Czech Republic, Slovakia, and Romania. When it comes to the shift to electric vehicles, these countries are moving the slowest.

Ranking conclusions

Electric vehicles are the key to a net-zero carbon future and the electric market is growing quickly. Compared to last year, almost all countries across the continent showed increased EV readiness. The nations positions in the ranking differ depending on the amount of BEVs and PHEVs purchased in each country, as well as based on the energy infrastructure, the number of electric chargers, and the consumer sentiment to sustainable mobility.

Here are the main conclusions concerning the countries mentioned in the ranking:

- In 2020 and 2021, Europe and China were the dominant EV markets, with over 80% of plug-in hybrid and battery electric vehicle sales. Currently, around 60% of EV sales worldwide come from China.

- In terms of electric vehicle batteries, China has about 66% of the world’s capacity for Li-ion battery manufacture, which puts it ahead of the rest of the world in the race for the most EV battery manufacturing.

- In Europe, Scandinavian countries have the highest EV readiness, with Norway being the most prepared country.

- Luxembourg, Germany and Belgium are performing better in the EV approach than they used to in the past.

- France and Portugal are in the right places to improve, whereas Italy and Spain have promising investments.

- According to Virta data, an electric vehicle charging platform, Germany, France, the United Kingdom, and Spain have a significant number of slow chargers in Europe. Other European countries are joining the electric vehicle revolution by adding fast(er) chargers.

- Europe is expected to have 14 million EVs by 2025 and 100% electric cars from 2040.

Global Electric Vehicle Forecasts

The global car industry is undergoing the most significant technological revolution in over a century, with a pivotal shift towards electric vehicles to stay competitive in the global market. Yet, the true challenge is not a competition among nations but a collective race against time to embrace sustainability. Despite the progress, EVs currently make up just 14% of the global vehicle fleet.

Looking into 2024 and further, more nations will plan ahead or strengthen their commitment to electric vehicles. In an effort to reach aggressive goals by year-end, manufacturers are preparing to launch a broader range of electric models. But it’s still unclear whether EVs will rule the roads by 2030. Global domination is not likely, even though some countries are well on their way. Making EVs more affordable for consumers and developing the infrastructure for charging them are essential steps on the path to the widespread adoption of EVs. This includes adding more fast charging stations to the network and making EVs more financially accessible to consumers.

Furthermore, it is crucial that governments of the above and other nations will make advances in EV technology. Smart charging systems are becoming more and more popular, with cloud-connected technology to use electricity more efficiently and give users more convenience and control. This trend is essential for improving user experience overall and maximising the integration of EVs into the energy grid. Accelerating the global shift to electric mobility will require coordinated efforts to expand infrastructure, improve technology, and lower costs.